Duties of the HCPA

Duties of the HCPA

Primary Responsibilities

The Property Appraiser’s primary statutory responsibilities include property valuation and the administration of various exemptions, agricultural classifications, assessment caps, and the preparation of the annual assessment roll (also referred to as the tax roll), as set forth by Florida law and the Florida Department of Revenue.

The Property Appraiser cannot lower your taxes because tax rates and tax levies are determined by the various taxing authorities which have discretion in those matters, such as the County Commission, School Board, Cities, etc.

The Property Appraiser cannot reduce property values when the market supports the current level of assessment required by the Florida Department of Revenue.

Even if market trends indicated a lower value, and the Property Appraiser was able to reduce the value assessed accordingly, the taxing authorities are authorized by State law to raise tax rates to get the same revenue they had the prior year without calling it a tax increase ( § 200.065 and Florida Administrative Code 12D-17.0035).

The Property Appraiser does not have the authority to lower taxes and a lowering of value assessed would not ensure lower taxes even if justified from the market.

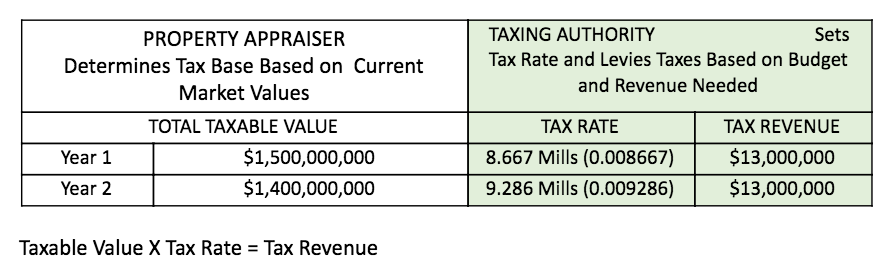

By Florida Law, the Property Appraiser cannot lower property taxes. The taxes levied by the taxing authority are determined by the revenue and spending needs of the taxing authority (County Commission, School Board, Cities, etc.). The above chart illustrates how any taxing authority is allowed by law to increase its tax rate to provide the same revenue as they had the prior year, even if the valuations, as assessed by the Property Appraiser, were reduced.

“Year 1” reflects a $1.5 billion dollar tax base (established by the Property Appraiser) times a 8.667 mill tax rate, (tax rate set by taxing authority) providing the taxing authority $13 million dollars in revenue. The subsequent year, “Year 2” reflects a $1.4 billion dollar tax base allowing the taxing authority to raise the tax rate to 9.286 mills in order to recover lost revenue, thereby providing the same $13 million in revenue.

The Property Appraiser’s primary job is to prepare an annual tax roll (assessment roll) which complies with Constitutional and specific State mandated standards in order that it will be approved each year by the Florida Department of Revenue.

To maintain an approvable tax roll, the Property Appraiser must estimate the current market value of all real and tangible property based upon data from real estate sales transactions and other current market data. This is done pursuant to the requirements of specific State laws. The tax roll is audited annually by the Florida Department of Revenue to ensure compliance.

The State is empowered to reject the Property Appraiser’s roll if the values assessed by the Property Appraiser are not at the levels required by the Florida Department of Revenue for any class of properties on the assessment roll. The Florida Department of Revenue will not approve the tax roll unless the level of assessment, overall and for each property class, is at least 90% of the just value required by the Constitution. This ratio is determined by comparing the just value to the actual selling price of all properties sold during the prior year. Since the valuation of all properties must reflect current market trends, values of all similar property types, even those which did not sell, must be adjusted to reflect current market trends.

Multiple assessment roll failures can result in severe action taken against the Property Appraiser by the Florida Department of Revenue and the Governor.

Your elected Property Appraiser has many strong incentives to produce an accurate and equitable assessment roll, and no incentive to raise or lower assessments, to deny or grant exemptions, to approve or disapprove agricultural classifications, as well as other administrative duties, for any reason other than to comply with Florida law as established by the Florida legislature and our voting citizens.